property tax in france 2020

Over the past two years. June 12th closing date for tax declarations done on paper.

French Property Income Tax Non Resident Tax Return Filing Pti

More households will be exempt from the taxe dhabitation this year as the gradual abolition of the tax continues.

. In French its known as droit de mutation. The tiers of wealth. The current threshold of 1300000 for the IFI real estate wealth tax will stay in place for 2020 with no changes to the scale rates of tax.

Taxe dhabitation is a residence tax. So this year 2020 you will be declaring according to your situation between 1 January 31 December 2019. CFE is an annual tax which is paid by owners of furnished properties in France based on the theoretical rental value of their property.

As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2020 is 49. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary residence. You have to pay this tax if you own a property and live in it.

Local property taxes in France are divided into housing tax a housing tax payable by whoever lives in a property such as their domicile on January 1 and property tax which. The rate from 1 January 2021 is 275 for all income. The tax typically amounts to between 100.

Tuesday 10 November 2020. Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. Unmarried couples should complete separate tax returns.

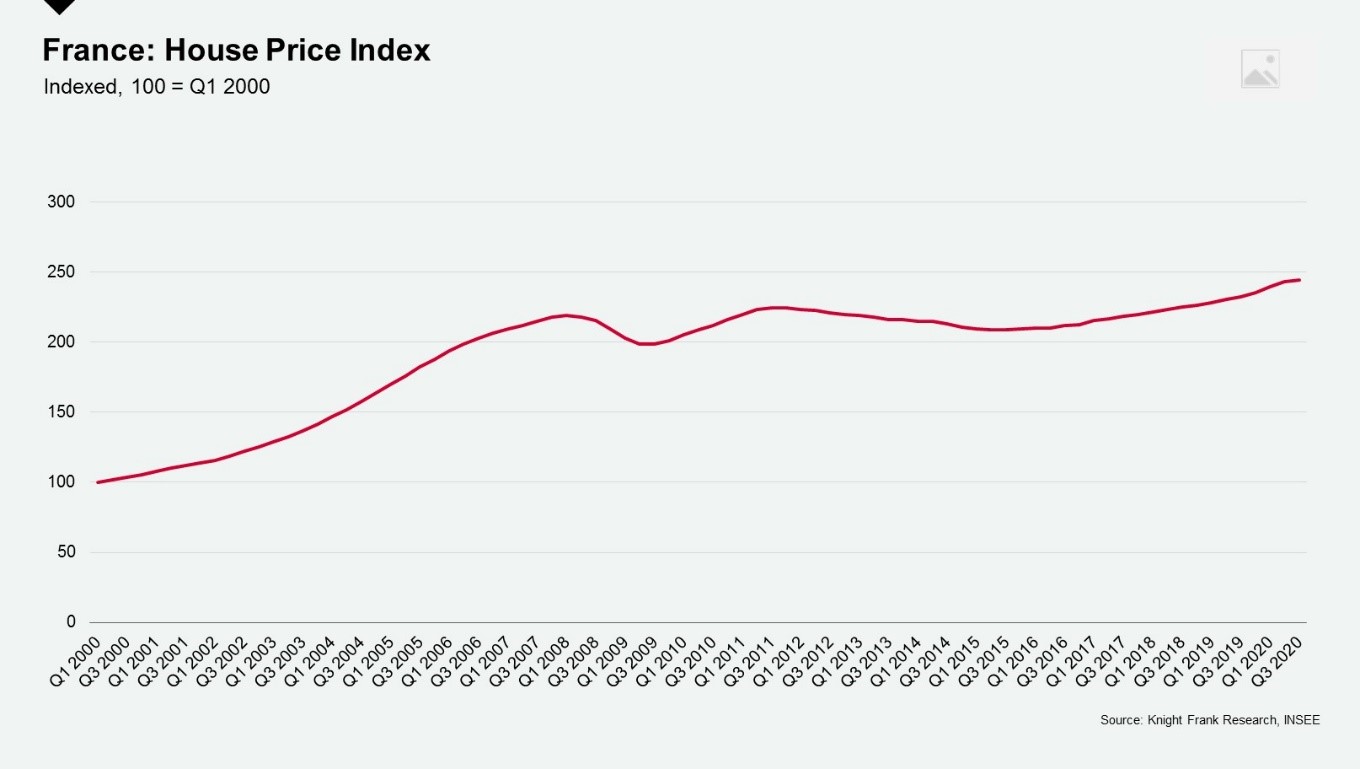

The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. The rates for the year 1 January to 31 December 2020 are 28 on the first EUR 500000 and 31 on the excess. In 2018 France abolished wealth tax on financial assets replacing it with IFI Impôt sur la Fortune Immobilière which is only applicable to real estate assets.

For example if you left France in 2020 you would need to file an income tax return in 2021 with the Tax Department with which you dealt prior to your departure. France has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 5875 to a high of 4000 for. Married Joint Tax Filers.

This relates to taxes owed for 2019 and anyone resident in France from April 2019 and onwards needs to fill in a return. France Non-Residents Income Tax Tables in.

Paying Property Tax In France Here S Your Full Guide Wise Formerly Transferwise

Post On French Property Tax Archives Benjamin A Kergueno Ll M

Brexit Second Homes In France What You Need To Know

![]()

Property Tax Advisory Services Deloitte Us

Taxe D Habitation French Residence Tax

Capital Gains Tax On The Sale Of French Property What You Need To Know Post Brexit Wellesley

Like Kind Exchanges Of Real Property Journal Of Accountancy

How Do Us Taxes Compare Internationally Tax Policy Center

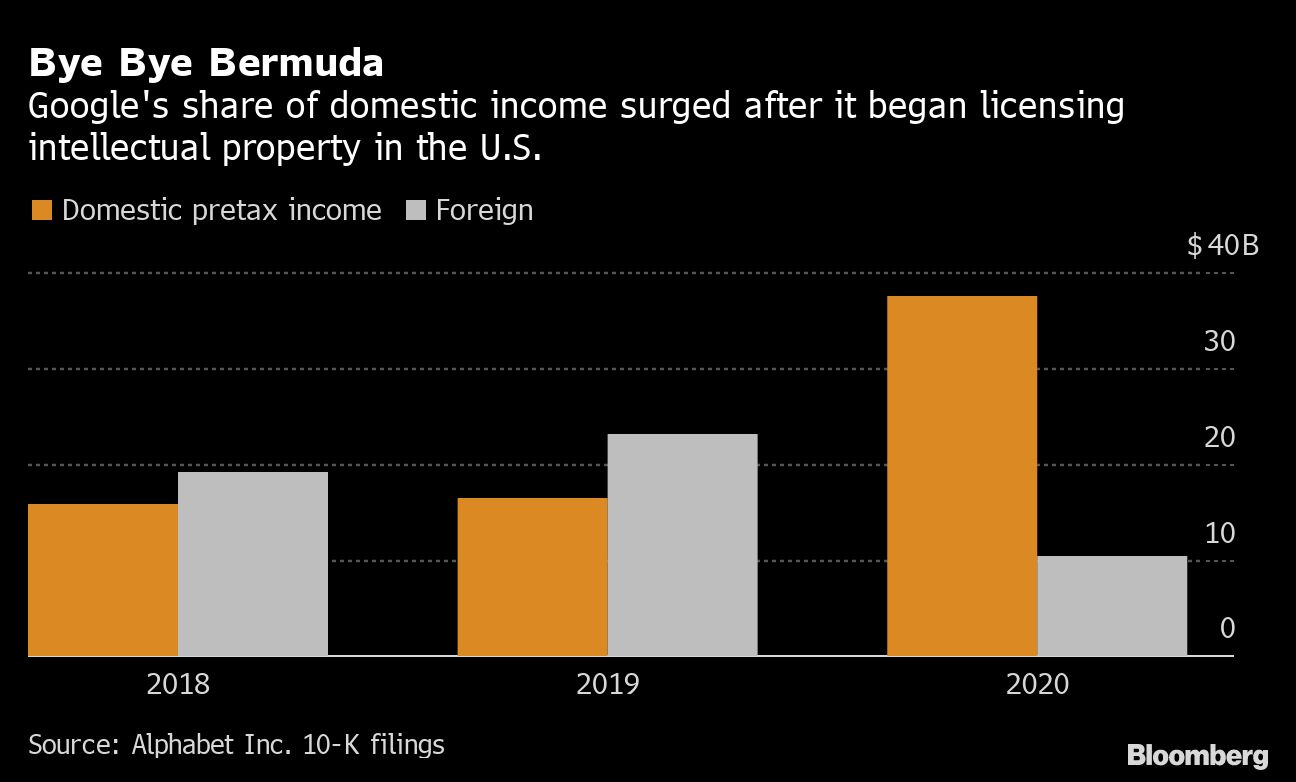

Intellectual Property Archives Accountant Pages

Tax Revenue Statistics Statistics Explained

Tax Plan Targets Big Tech S 100 Billion In Foreign Profits Treasury Risk

List Of Countries By Tax Rates Wikipedia

Tax Hikes Of Up To 60 For French Second Home Owners

Expat Taxes In France A Guide For Americans Living Abroad

Seoul Studying To Ease Property Tax Hovering Above Oecd Average Pulse By Maeil Business News Korea

Permian Isds Received 978 75 Million Counties Received 334 3 Million In Oil And Gas Property Taxes In Fiscal Year 2020 Texas Oil Gas Association

French Bumper Pack France Living France Property News Jan Feb 2020 Torn Package 74470220732 Ebay